Summary of using 529 plans for college expenses

You can cover your college savings gap with student loans or other funding sources. To accurately predict your savings gap, the calculator accounts for your current savings, expected monthly contribution, and projected costs. Knowing the EMI in advance allows you to streamline your finances and plan your budget in a way that you can accommodate the EMI without affecting your other mandatory expenses.This college savings 529 calculator gives you a realistic picture of your projected savings and potential funding shortfalls. It enables you to adjust the loan amount and tenure by entering different permutations and combinations of principal amount and term, to arrive at an affordable EMI amount. The EMI calculator removes the need for manual calculations and errors. What are the advantages of a Home Loan EMI Calculator?ĮMI calculators prepare you for the Home Loan by predicting the potential EMI payable even before your home loan is sanctioned.

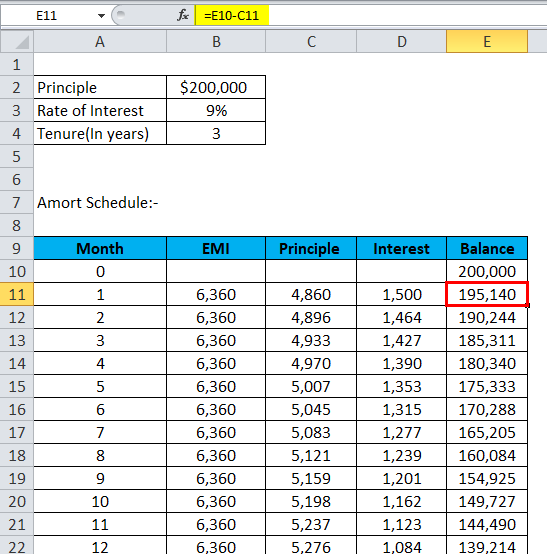

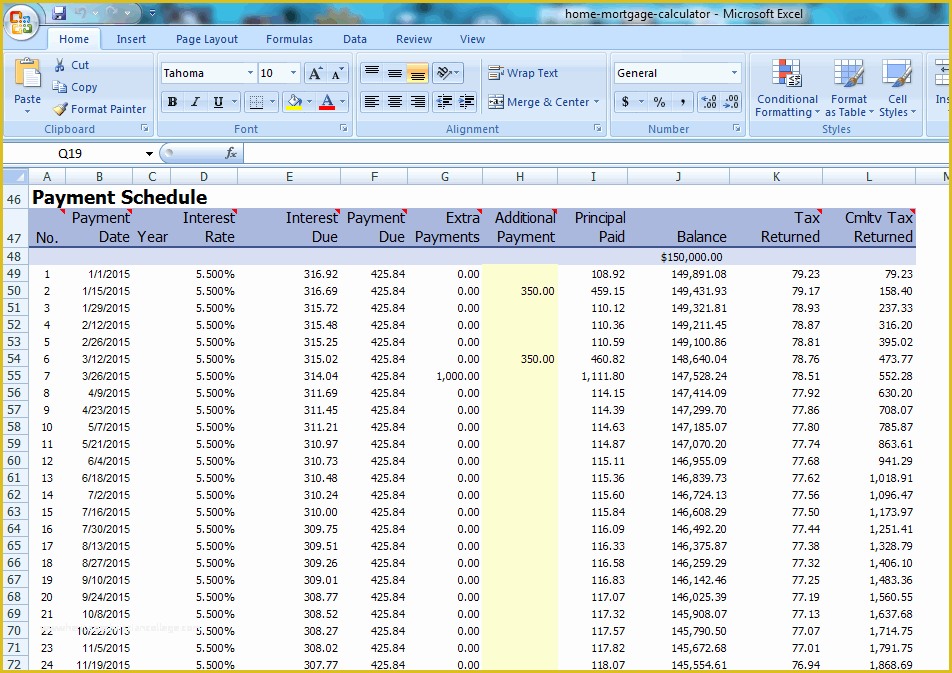

Loan Tenure (In Years): Input the desired loan term for which you wish to avail the housing loan.Ī longer tenure helps in enhancing the eligibility Interest Rate (% P.A.): Input interest rate. Loan Amount: Input the desired loan amount that you wish to avail. The online tool will compute the EMI amount instantly.Ĭalculate your Bank of Baroda Home Loan EMI amount in three simple steps with our instant Home Loan calculator: The EMI calculator uses the formula EMI = / to compute the EMI amount.Įnter the principal loan amount you need, a reasonable interest rate, and the loan’s tenure. But before you use it, you should have a rough estimation of the principal loan amount you need and the EMI you can pay, based on your monthly Using a Home Loan EMI calculator is incredibly easy and enables you to calculate the EMI amount within a second. Typically, the EMI amount is lower if you opt for a longer tenure loan, and higher if you opt for a short tenure loan. The monthly EMI payable against the loan depends on the amount loaned, the interest rate levied, and the borrower’s repayment tenure. The EMI comprises a portion of the principal amount loaned to purchase the property and a portion of the interest component payable against An Equated Monthly Instalment or EMI is the fixed sum of money you pay each month whilst repaying your Home Loan.

0 kommentar(er)

0 kommentar(er)